Pitchdeck

Pitchdeck

Building Mission Critical Infrastructurefor Private Markets

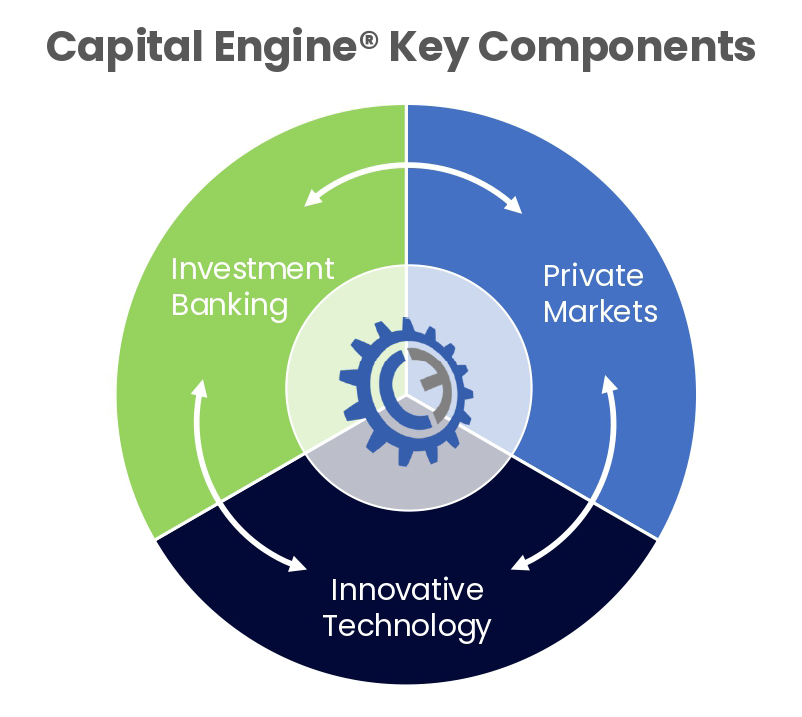

Capital Engine® is a global fintech firm that operates at the intersection of private markets, investment banking, and tech-driven innovation.

The firm leverages its proprietary technology and expertise to offer a comprehensive suite of services, including a network of retail-focused investment platforms, an enterprise advisory arm, and investment banking operations facilitated through its acquisition of Mallory Capital Group, a registered broker-dealer and member of SEC and FINRA.

We are transforming Private Markets and Secondaries Trading Infrastructure

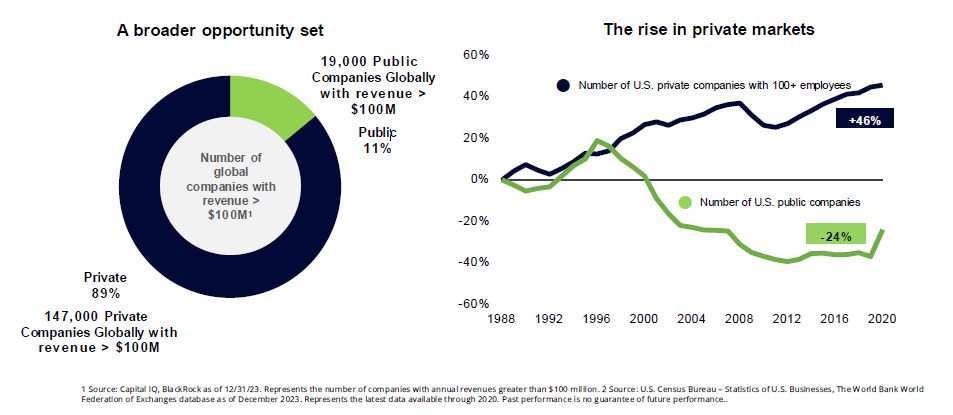

Private Securities Markets Lack the Infrastructure of Public Markets*

Investor Access

Limited Liquidity

Transparency

* There is no established secondaries trading platform for exempt private securities market to match the public market infrastructure of the NYSE or Nasdaq

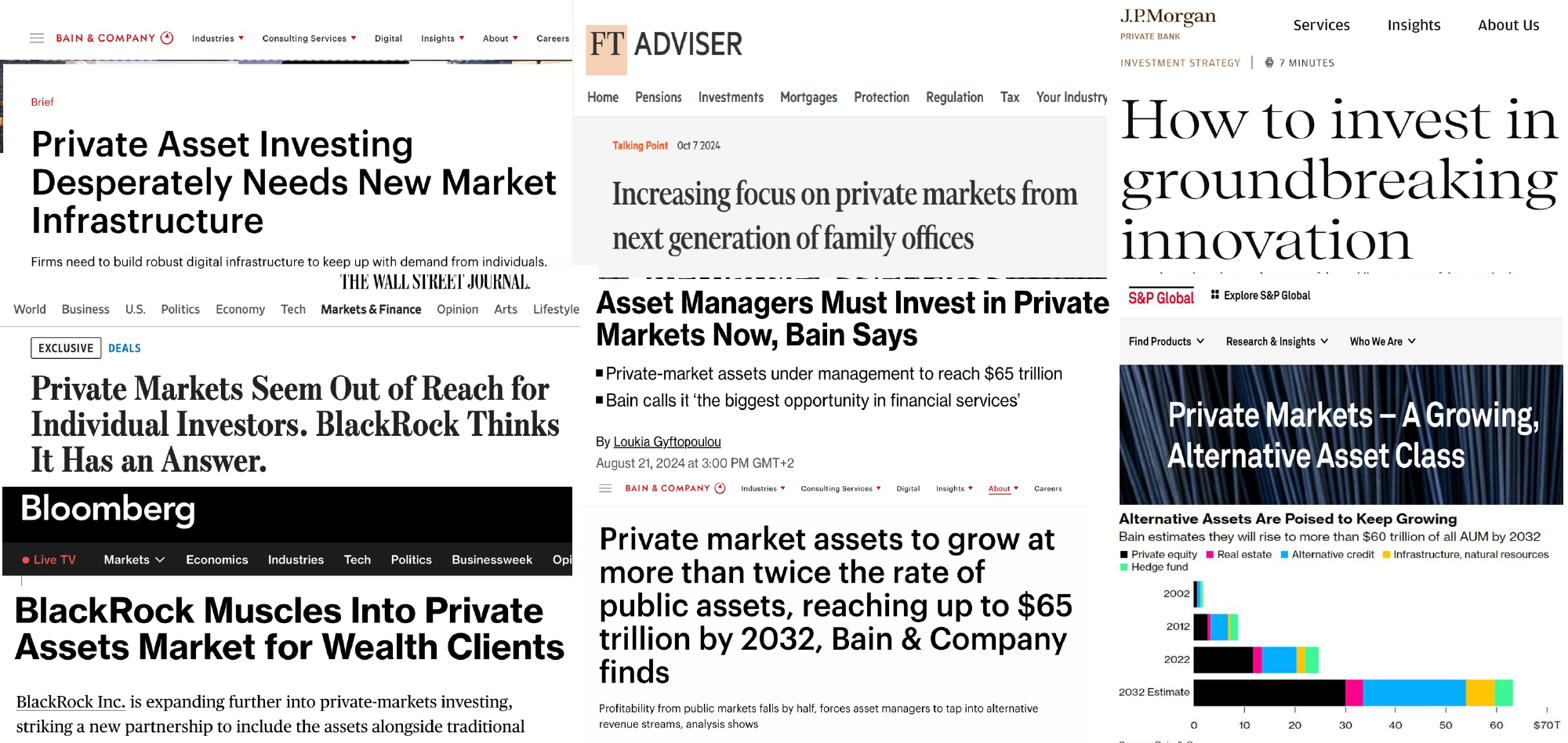

Rise of the Retail Investor

The Next Big Shift in Financial Services

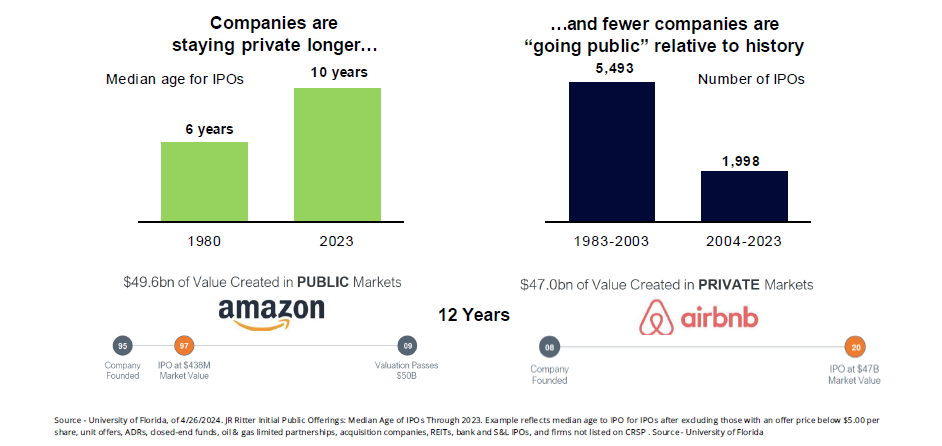

Private markets are no longer the exclusive domain of institutional investors. A seismic shift is underway, with retail investors demanding access to alternative assets like private equity, venture capital, real estate, and private credit.

- ✔️ 70% of high-net-worth individuals are open to investing in private markets with the right access

- ✔️ New fund structures, like interval and evergreen funds, are unlocking participation

- ✔️ General Partners (GPs) face operational hurdles in onboarding, managing, and reporting for retail investors at scale

- ✔️ President Trump recently signed an executive order democratizing access to alternative assets in 401(k)s

The financial services industry is not yet fully equipped to support this transition, creating a multi-trillion-dollar gap in investment infrastructure.