Background to westbrooke USA residential

Westbrooke USA Residential was established by Westbrooke Alternative Asset Management (“Westbrooke”) in 2016 (who remain a c.23% shareholder), with a mandate to invest into a diversified portfolio of multifamily and other niche multifamily residential properties across the USA alongside established, US-based operating partners.

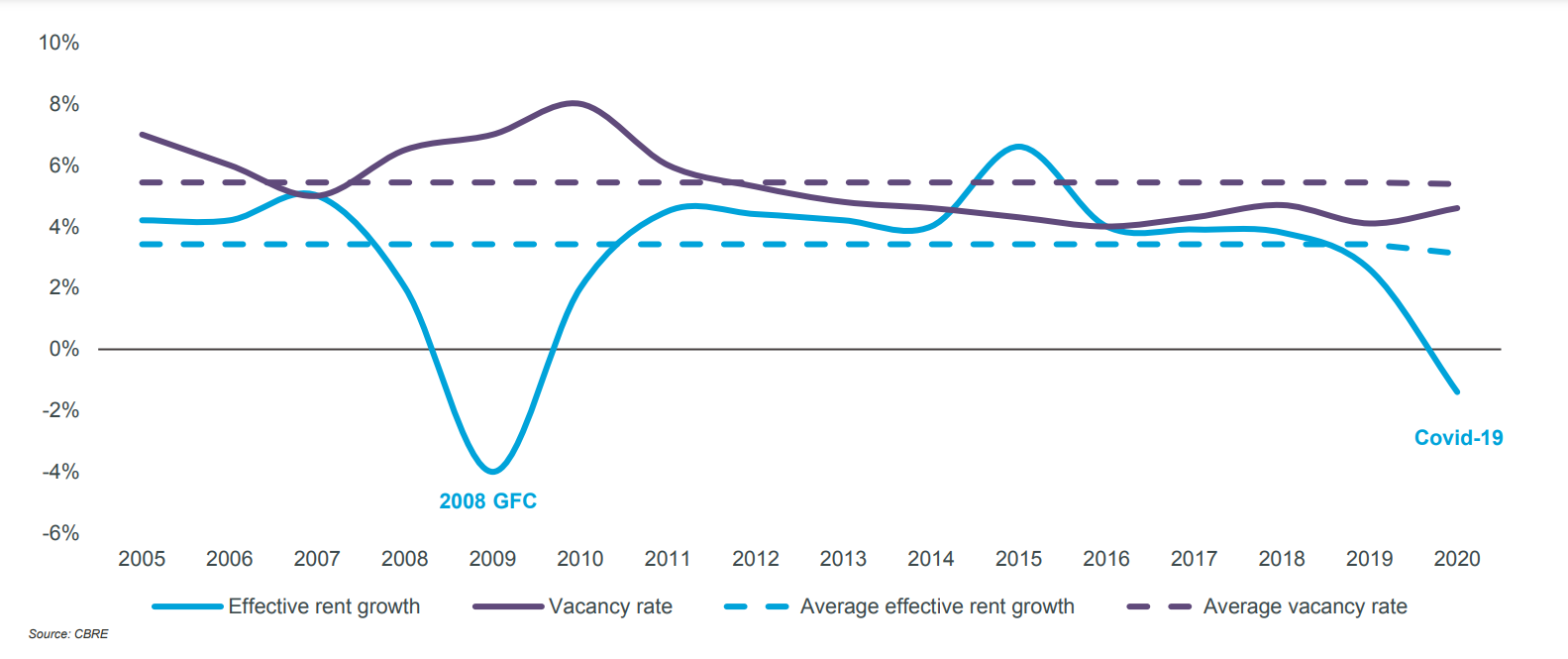

The Fund invests into a diversified portfolio of assets across America, with a focus on generating strong risk-adjusted returns in the form of a quarterly cash flow from operating income and capital appreciation by enhancing the value of the underlying properties owned. Since inception, the Fund has achieved average annual distributions of 5.4% p.a. and an overall investment IRR in excess of 12% p.a.

The Fund is structured as a regulated BVI Private Fund and is administered by Sanne Group in Jersey. Funds flow in to and out of the USA in a tax efficient manner, negating the adverse impact of US withholding taxes on foreign payments and ensuring that Fund investors have no US taxation, reporting or other obligations.

Fund composition

-

$200m

Gross property value across 7 properties in 3 states

-

1,350

Residential units in the portfolio

-

5.4%

Average annual cash-on-cash yield achieved to date

-

12%+

IRR achieved to date (based on current portfolio valuation)

-

4

Experienced and trusted partners that we invest alongside

-

67%

Average LTV across the portfolio

-

3.1%

Fixed rate debt on latest investment, with an average Fund LTV of 67%

Why westbrooke?

Founded in 2004 and with offices in Johannesburg and London, Westbrooke invests and manages capital in multiple geographies on behalf of its shareholders and investors in Private Equity, Venture Capital, Private Debt, Hybrid Equity and Real Estate. We manage approximately R6bn of shareholder and investor capital invested predominantly in SA, the UK and USA.

Westbrooke Alternative Asset Management was established as a multi-asset, multi-strategy manager of alternative investment funds and products structured to preserve and compound our clients’ wealth to cement their future prosperity.

Our team is comprised of experienced entrepreneurs and investment professionals who apply a broad range of experience and skills to deliver investment opportunities which offer a simple investable outcome – predictable, sustainable, risk managed long term returns for investors in an increasingly complex environment.

We have a heritage as a shareholder and operator of assets, investing our own capital to develop and grow our businesses and assets. We believe our operational experience and expertise gives us and our investors a competitive advantage. We are wholly committed to financial alignment. We invest materially alongside our clients and partners in all our funds and investments