VALUE INVESTING

VALUE INVESTING

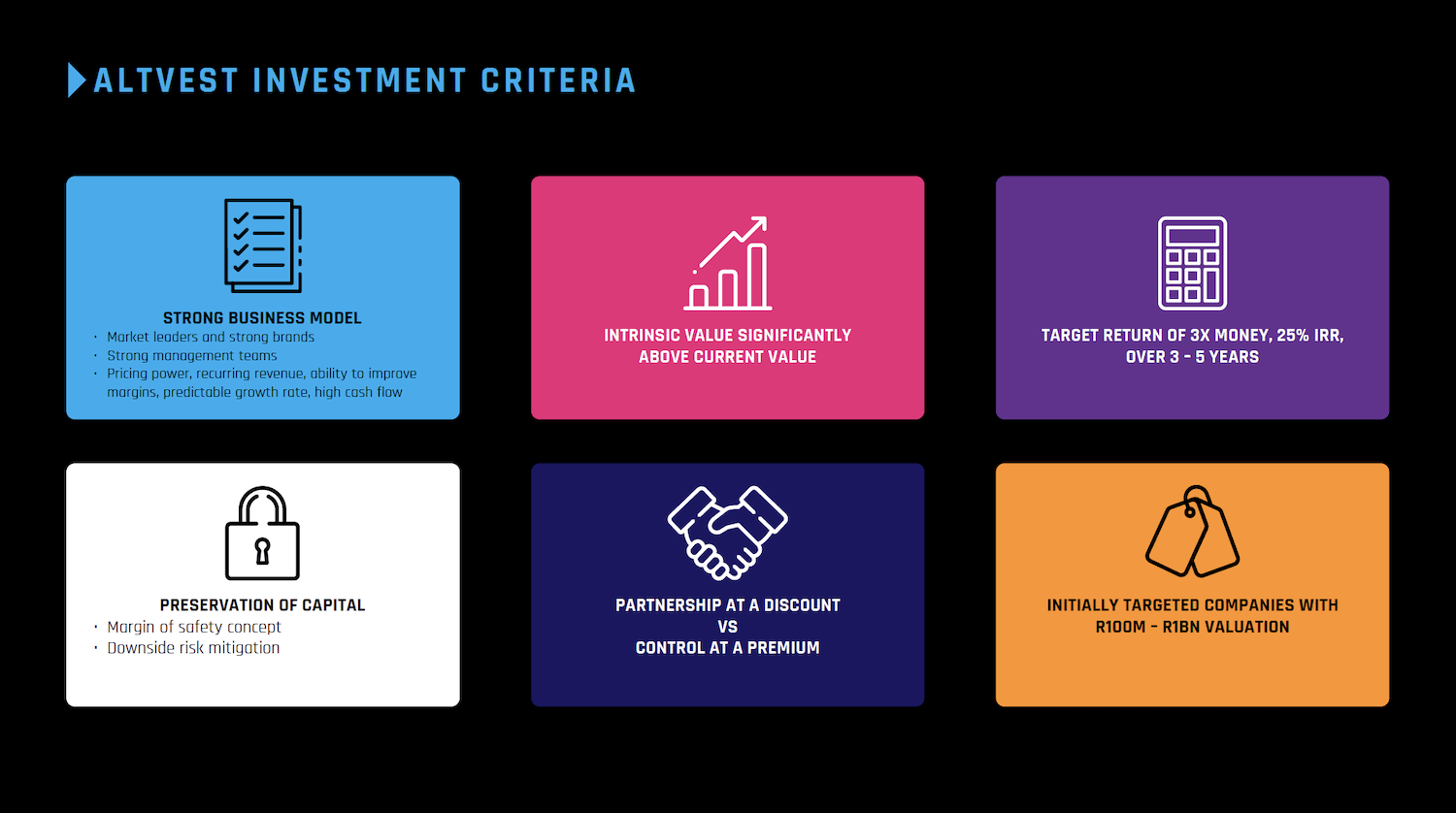

An investor with an appreciation that value is created at the point of buying and this should be done significantly below intrinsic value.

PROTECTION OF CAPITAL

PROTECTION OF CAPITAL

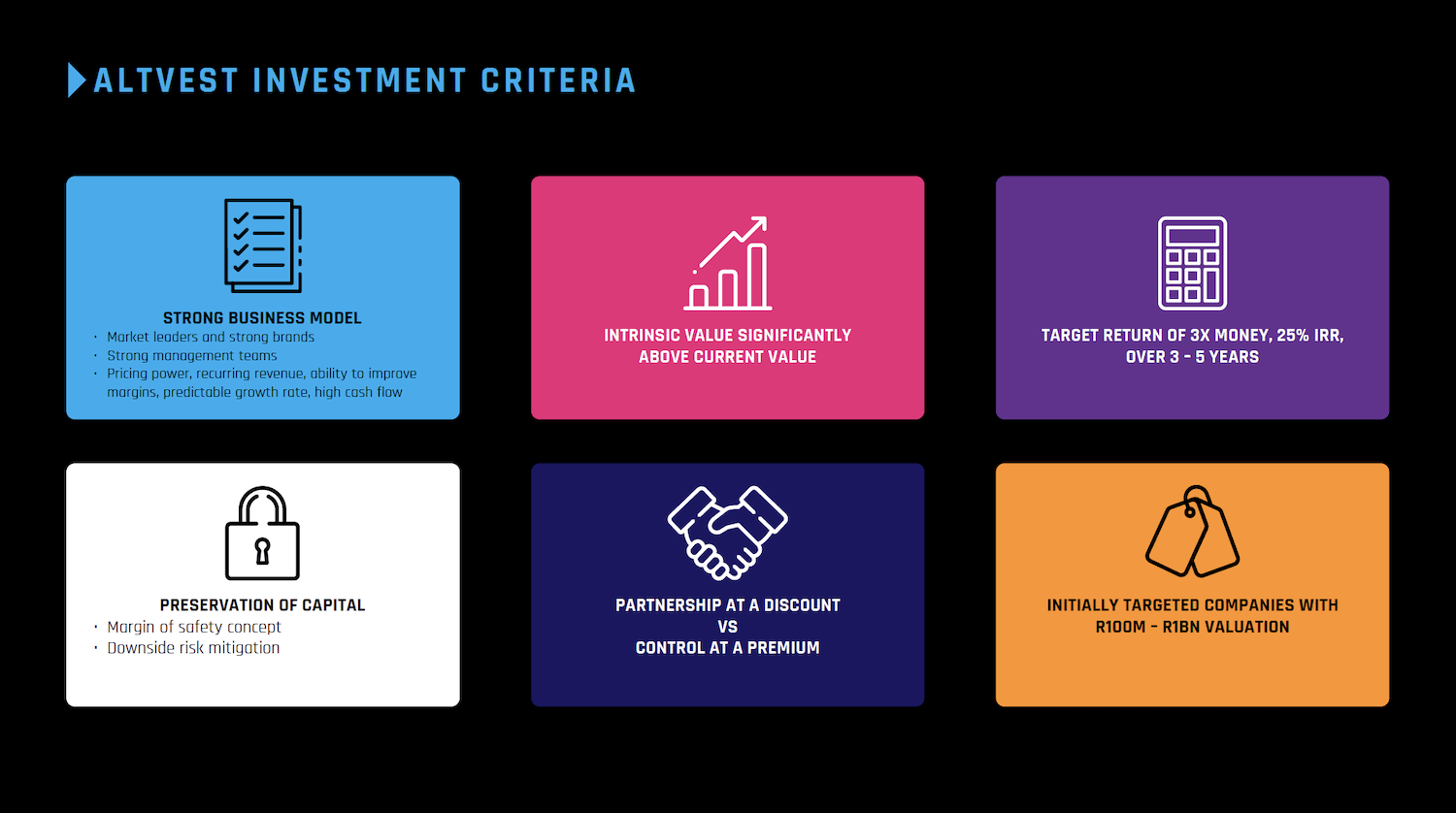

More time is spent upfront understanding the downside risk to each investment and having a substantial margin of safety between intrinsic value and share price. Returns are secondary to protection of permanent capital.

UNDERVALUED BUSINESS

UNDERVALUED BUSINESS

AltVest invests in strong businesses that are undervalued, rather than targeting turnarounds. The business should function efficiently without AltVest intervention.

ATTRACTIVE BUSINESS MODEL

ATTRACTIVE BUSINESS MODEL

AltVest’s definition of an attractive business model includes factors such as strong brands, pricing power in the

chosen market usually through unique competitive advantages, an ability to improve operating margins, strong management teams, healthy balance sheet and strong cash flows.

PARTNERSHIP

PARTNERSHIP

Control is not critical for the Altvest business model. We prefer partnership at a discount to control at a premium.

ALIGNMENT OF STAKEHOLDER INTEREST

ALIGNMENT OF STAKEHOLDER INTEREST

Alignment of interests with investors, shareholders and management. Altvest founders and staff are significant investors in their own business, which provides a stable pool of permanent capital to match the investment horizon of investee.

OPERATING MODEL

OPERATING MODEL

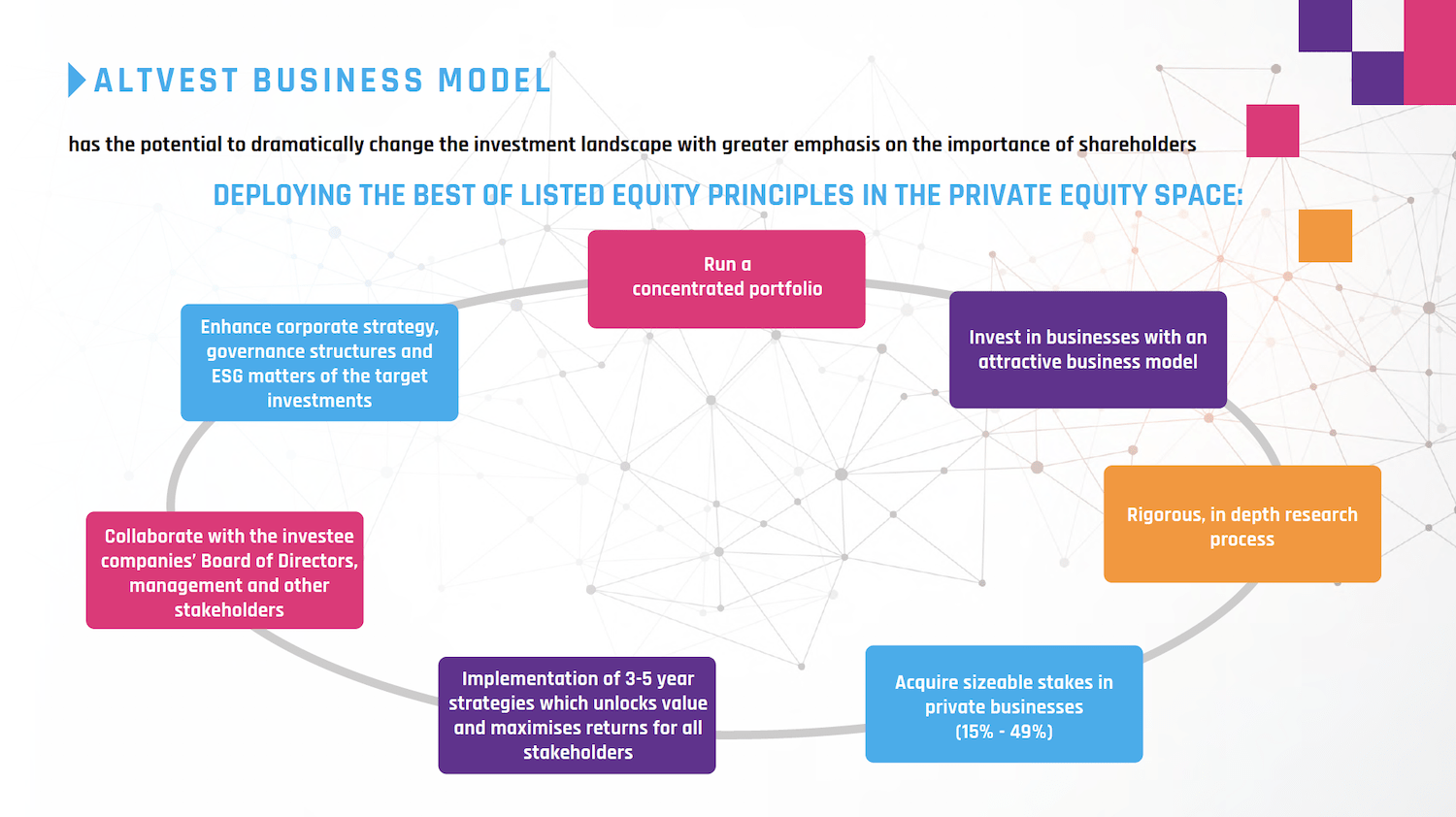

Our hands on involvement in portfolio companies aims to deploy the best of private equity principles in the listed space

SHAREHOLDER ENGAGEMENT

- Foster collaborative relationships with key shareholders

- Align shareholders, Board and management towards common goal

- Leverage relationships with major shareholders to fast track decision making

- Keep major shareholders appraised of key business developments

|

EXECUTIVE MANAGEMENT

SUPPORT

- Talk to CEO/ CFO 2 3 times a month

- Meet with CEO & Chairman at least once a month

- Assist with strategy formulation

- Leverage extensive network to identify and help recruit key management personnel, conduct interviews, structure and negotiate remuneration packages

- Partner with best in class industry leaders to drive value unlock strategy

|

PERFORMANCE MANAGEMENT AND CAPITAL ALLOCATION

- Detailed analysis of monthly management accounts

- Assist with negotiation of debt refinancing / restructuring

- Enforce capital allocation discipline

- Oversee and assist execution ofM&A and bolt on acquisitions (where appropriate)

|

CORPORATE GOVERNANCE

- Manage the dynamics & composition of the Board of Directors

- Chair the Investment Committee and Remuneration Committee

- Evaluation of Board effectiveness

- Advise on investor relations and corporate communications strategy

- Integrate and improve ESG matters

|

SHAREHOLDER ENGAGEMENT

- Foster collaborative relationships with key shareholders

- Align shareholders, Board and management towards common goal

- Leverage relationships with major shareholders to fast track decision making

- Keep major shareholders appraised of key business developments

|

EXECUTIVE MANAGEMENT

SUPPORT

- Talk to CEO/ CFO 2 3 times a month

- Meet with CEO & Chairman at least once a month

- Assist with strategy formulation

- Leverage extensive network to identify and help recruit key management personnel, conduct interviews, structure and negotiate remuneration packages

- Partner with best in class industry leaders to drive value unlock strategy

|

PERFORMANCE MANAGEMENT AND CAPITAL ALLOCATION

- Detailed analysis of monthly management accounts

- Assist with negotiation of debt refinancing / restructuring

- Enforce capital allocation discipline

- Oversee and assist execution ofM&A and bolt on acquisitions (where appropriate)

|

CORPORATE GOVERNANCE

- Manage the dynamics & composition of the Board of Directors

- Chair the Investment Committee and Remuneration Committee

- Evaluation of Board effectiveness

- Advise on investor relations and corporate communications strategy

- Integrate and improve ESG matters

|

VALUE UNLOCK STRATEGIES

VALUE UNLOCK STRATEGIES

Through collaboration and private engagement:

- Assistance with strategy formulation and implementation

- Remuneration policies – align with shareholder value creation

- Capital allocation policies – bolt-on acquisitions, disposals, share buybacks, dividend policy

- Attraction of top talent to boards and executive management of investee companies

- Managing board relationships and dynamics

- Management selection and succession planning, including transformation

- Financial planning and analysis